Saga Metals Corp. (‘SAGA’ or the ‘Company’) (TSXV: SAGA,OTC:SAGMF) (OTCQB: SAGMF) (FSE: 20H) a North American exploration company focused on critical mineral discovery, is pleased to announce SAGA’s team has completed the 4 km access trail along the core of the Trapper zone providing necessary access for future drill programs and exploration activities. The access trail is located to run along the surface trend of extensive outcropping and sub-cropping oxide layers. In addition, a 25-tonne excavator from Gladiator drilling has opened 3 trenches across the two significant aeromagnetic anomalies of the Trapper zone, exposing a total of 504m 2 (5,425ft 2 ) of semi-massive to massive vanadiferous titanomagnetite (‘VTM’) mineralization.

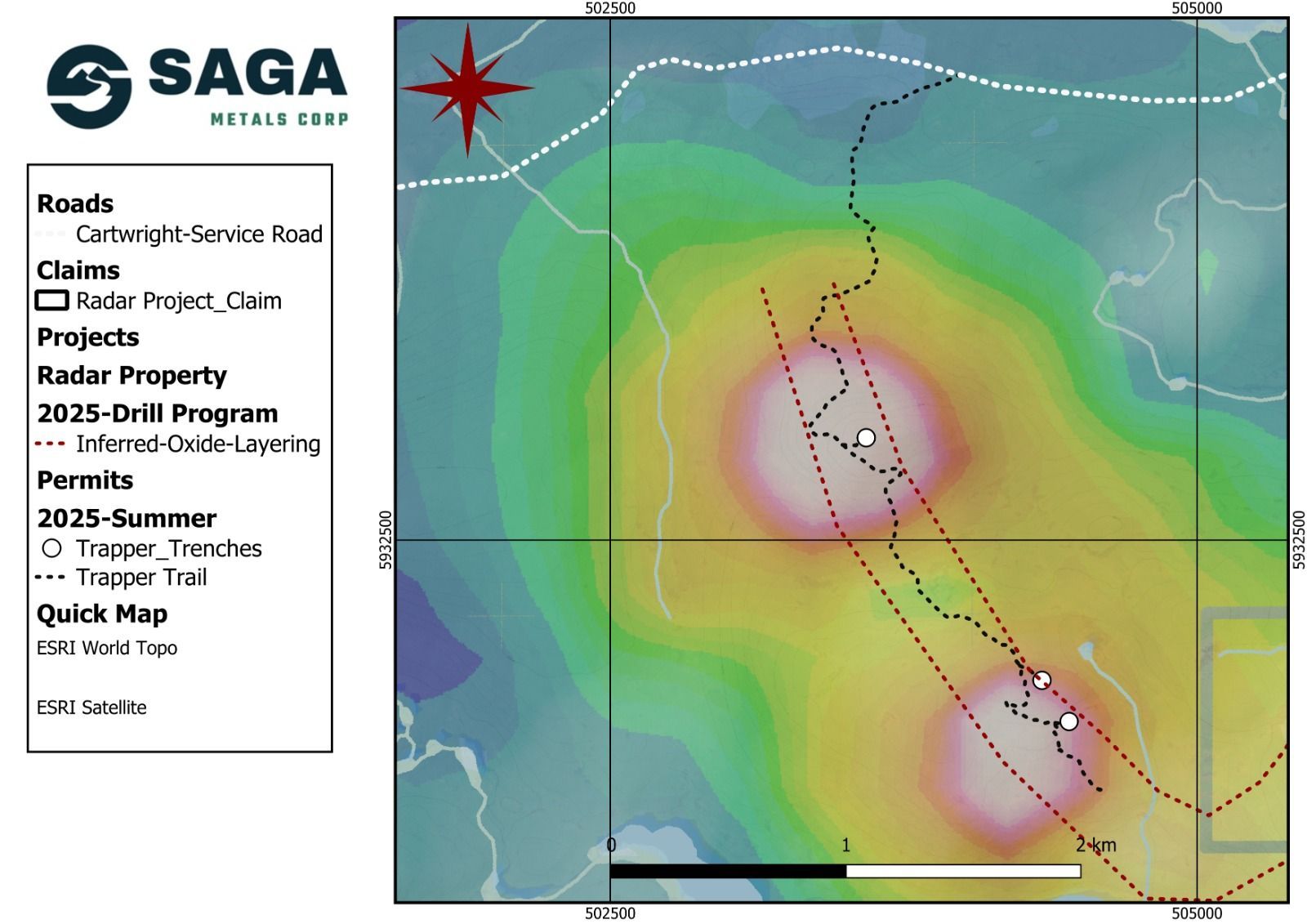

Figure 1 : Radar Pro ject’s Trapper Zone depicting two aeromagnetic anomalies and the trend of the inferred oxide layering. The Trapper trail will support a new diamond drilling program. SAGA has demonstrated the reliability of the regional airborne magnetic surveys after ground-truthing and drilling in the 2024 and 2025 field programs.

Located just 10 km from Cartwright, Labrador, the 24,175-hectare Radar Titanium Project is supported by existing infrastructure, including road access, a deep-water port, an airstrip, and nearby hydroelectric power. The property completely encompasses the Dykes River Intrusive Complex, a previously underexplored layered mafic body.

With a large oxide layering thickness, a near-monomineralic Vanadiferous Titanomagnetite (VTM) composition, and extensive mineral tenures, the Radar Titanium Project shows the potential to become a globally significant VTM project.

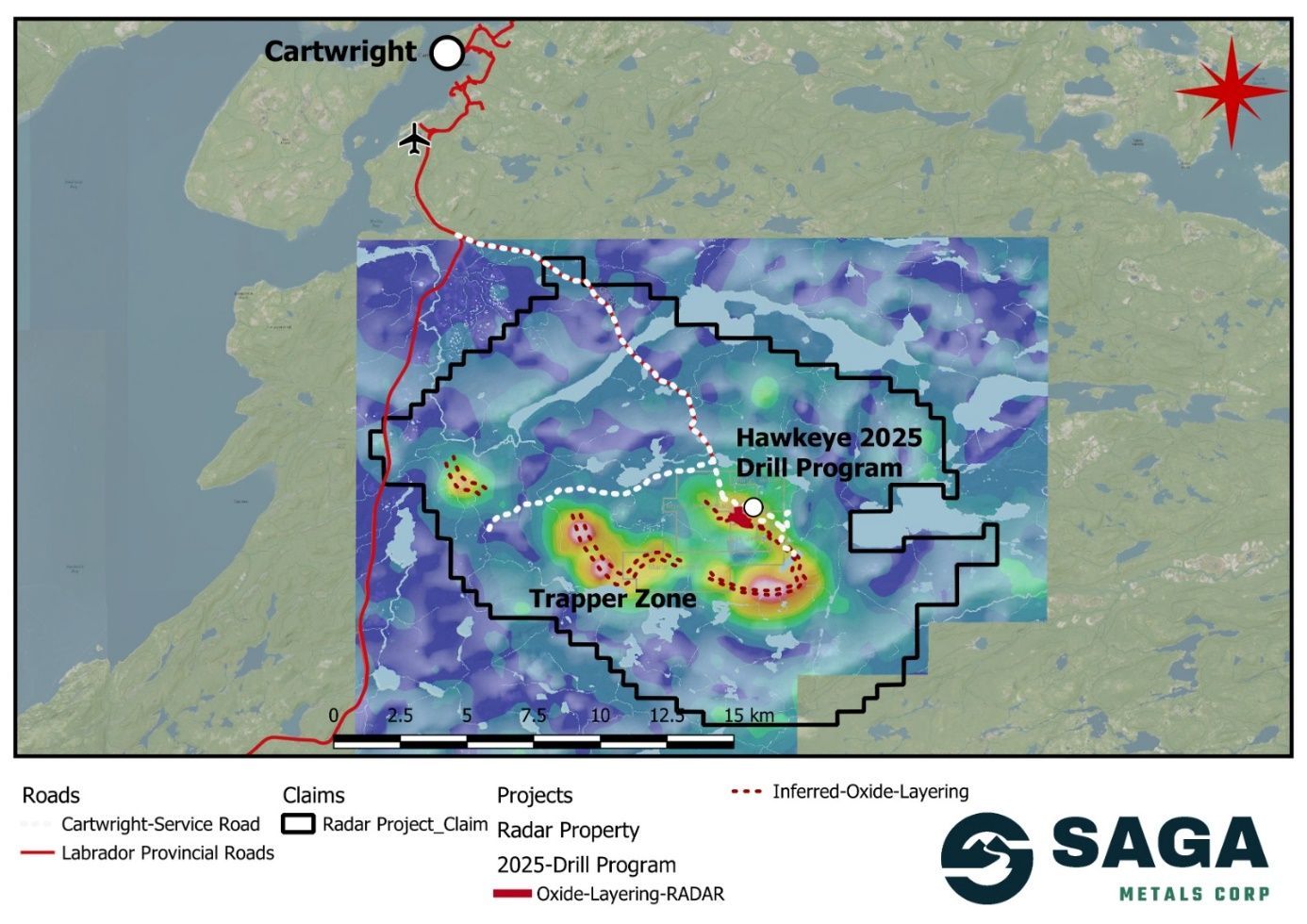

Figure 2: Radar Property map, depicting aeromagnetic anomalies, oxide layering and the site of the 2025 drill program. The Property is well serviced by road access and is conveniently located near the town of Cartwright, Labrador. A compilation of historical aeromagnetic anomalies is shown. SAGA has demonstrated the reliability of the regional airborne magnetic surveys after ground-truthing and drilling in the 2024 and 2025 field programs.

2025 Summer Field Program – Road Maintenance, Trail Access, Trenching and Geophysics

The 2025 summer field program marked a critical phase in advancing the exploration efficiency and cost-effectiveness of future drill programs and exploration activities in the western portion of the property, including the highly prospective Trapper zone. Key components of this program include:

- Maintenance of the forestry road

- Construction of the drill rig compatible access trail across the Trapper zone

- Trenching in the Trapper and Hawkeye zones

- Ground-based magnetometer surveys over the two major anomalies in the Trapper zone

- Forestry Road Maintenance:

The first step for the team was to perform maintenance on the Cartwright Forest Service road, which had not seen regular clearing for the last few decades. This work included:

- Objective: Clear overgrown sections of the existing forestry road to enable access for trucks and heavy equipment to reach the laydown area. This road is essential for allowing the team proper access to the west of the property claims, and includes an equipment lay-down area and an access trail into the Trapper Zone.

- Work: Brush-cutting and removal with heavy equipment.

- Equipment: Brush-saws, Chain-saws, 6-tonne excavator, 25-tonne excavator.

- Outcome: The 4.2 km of refurbished track now provides reliable access to the lay-down area, enhancing logistical efficiency for the Trapper zone trail building.

Figure 3.1: Completed maintenance on the Cartwright Forest Service Road

Figure 3.2: Start of the Trapper Zone Trail, viewed from the lay down along the Cartwright Forest Service Road

2. Trapper Trail Construction:

The next phase of infrastructure development aimed to upgrade the pre-existing snowmobile/ATV trail into a drill rig-compatible trail, which gains access to the heart of the Trapper zone and extends past the two major anomalies. This work included:

- Facilitate Access: Provide direct trail access into the Trapper Zone on the western extent of the 20 km aerial oxide layer of the Dykes River Intrusion, connecting the eastern Hawkeye Zone to the western Trapper Zone.

- Support Drilling Operations: Enable efficient mobilization of diamond drilling equipment to high-priority targets identified through geophysical surveys within the Trapper zone.

- Enhance Cost Efficiency: Reduce logistical costs for future exploration campaigns by leveraging existing infrastructure and minimizing reliance on helicopter support.

- Ensure Sustainability: Minimize environmental impact through strategic trail planning and compliance with Newfoundland and Labrador’s permitting requirements.

Figure 3.3: Excavator and work truck located along the Trapper Trail over the northern portion of the oxide layer trend within the Trapper zone.

3. Trapper & Hawkeye Zone Trenching:

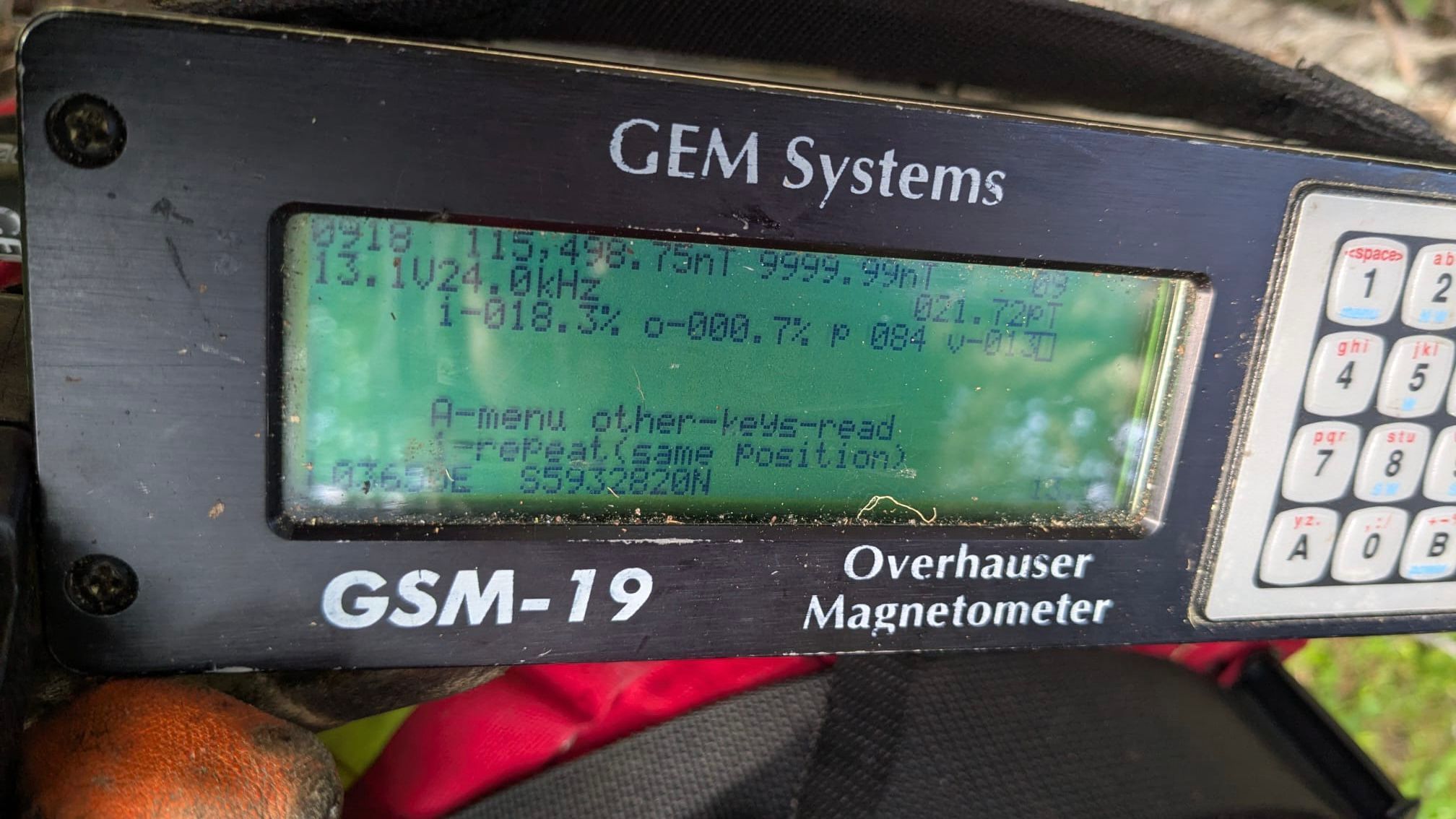

The trenches within the Trapper zone were identified as targets due to extremely high readings on the GSM-19 Magnetometer. On numerous occasions, the geophysics team had the GSM-19 Magnetometer Instruments reading well beyond the highest highs of the Hawkeye zone, which reached 74,000 nt.

Upon trenching these locations, it was discovered that the presence of semi-massive to massive VTM – oxide layering outcrops were not far from the surface. A total of 504m 2 (5,425ft 2 ) was trenched across the oxide layering strike in the north and south anomalies of the Trapper zone. Work is ongoing to complete pressure washing of the outcrops, clearing away dirt and debris to better show the structure and mineralogy of these exposures.

Figure 4.1: Excavator and Michael Garagan (CGO & Director of SAGA) standing on a VTM oxide layer outcrop in the northern anomaly at the Trapper zone.

Figure 4.2: Semi-massive to Massive VTM oxide layer outcrop in the southern anomaly at the Trapper zone.

4. Trapper Zone Geophysics:

As previously reported, SAGA mobilized two geophysical crews to complete magnetic and VLF-electromagnetic survey coverage across the north and south anomalies within the Trapper Zone.

SAGA’s geophysics team has continued to report strong magnetic detection levels over both anomalies, requiring recalibration of the geophysical instruments. The team is excited to report that readings have exceeded the 74,000 nT detected in the Hawkeye zone, with readings recorded as high as 115,498 nT over the northern Trapper zone anomaly and over 113,000 nT over the southern Trapper zone anomaly. In some cases, the instruments reached the maximum level of detection (120,000 nt).

Figure 5: Reading off of the Magnetometer GSM-19 geophysical instrument recording 115,498 nT over the Tapper zone.

SAGA’s geophysics team is working to complete the remaining lines over the coming days and will be the subject of a future new release in the near term.

Michael Garagan, CGO & Director of SAGA stated: ‘This summer has been a critical juncture in the development of the project and preparation for efficient and cost-effective drilling in the future. We believe that with the infrastructure upgrades completed our drilling cost per meter has come down significantly, setting us on the right track to reach our goal of approximately $300-$350/m. SAGA’s plans and objectives over the next 12-month are to complete a 10,000-15,000-meter drill program, setting the stage for the completion of a maiden resource calculation. A project like this, with homogenous geochemistry and large oxide layers, can move towards a resource calculation with 100 m drill spacing over the 2.5 km stretch of the entire oxide layering strike that runs continuously through the Trapper zone.’

Qualified Person

Paul J. McGuigan, P. Geo., is an Independent Qualified Person as defined under National Instrument 43-101 and has reviewed and approved the technical information related to the Radar Ti-V-Fe Project disclosed in this news release.

About Saga Metals Corp.

Saga Metals Corp. is a North American mining company focused on the exploration and discovery of a diversified suite of critical minerals that support the global transition to green energy. The Radar Titanium Project comprises 24,175 hectares and entirely encloses the Dykes River intrusive complex, mapped at 160 km² on the surface near Cartwright, Labrador. Exploration to date, including a 2,200m drill program, has confirmed a large and mineralized layered mafic intrusion hosting vanadiferous titanomagnetite (VTM) with strong grades of titanium and vanadium.

The Double Mer Uranium Project, also in Labrador, covers 25,600 hectares featuring uranium radiometrics that highlight an 18km east-west trend, with a confirmed 14km section producing samples as high as 0.428% U 3 O 8 and uranium uranophane was identified in several areas of highest radiometric response (2024 Double Mer Technical Report).

Additionally, SAGA owns the Legacy Lithium Property in Quebec’s Eeyou Istchee James Bay region. This project, developed in partnership with Rio Tinto, has been expanded through the acquisition of the Amirault Lithium Project. Together, these properties cover 65,849 hectares and share significant geological continuity with other major players in the area, including Rio Tinto, Winsome Resources, Azimut Exploration, and Loyal Metals.

With a portfolio that spans key minerals crucial to the green energy transition, SAGA is strategically positioned to play an essential role in the clean energy future.

On Behalf of the Board of Directors

Mike Stier, Chief Executive Officer

For more information, contact:

Rob Guzman, Investor Relations

Saga Metals Corp.

Tel: +1 (844) 724-2638

Email: rob@sagametals.com

www.sagametals.com

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Disclaimer

This news release contains forward-looking statements within the meaning of applicable securities laws that are not historical facts. Forward-looking statements are often identified by terms such as ‘will’, ‘may’, ‘should’, ‘anticipates’, ‘expects’, ‘believes’, and similar expressions or the negative of these words or other comparable terminology. All statements other than statements of historical fact, included in this release are forward-looking statements that involve risks and uncertainties. In particular, this news release contains forward-looking information pertaining to the exploration of the Company’s Radar Project. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, environmental risks, limitations on insurance coverage, inherent risks and uncertainties involved in the mineral exploration and development industry, particularly given the early-stage nature of the Company’s assets, and the risks detailed in the Company’s continuous disclosure filings with securities regulations from time to time, available under its SEDAR+ profile at www.sedarplus.ca. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements only as expressly required by applicable law.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/e8128200-d3b7-48da-aee0-484bad883fca

https://www.globenewswire.com/NewsRoom/AttachmentNg/6c8d3aa5-99b1-4eba-ab0c-616ac8aa84eb

https://www.globenewswire.com/NewsRoom/AttachmentNg/26751ee2-942d-431f-8bf1-c64df78353de

https://www.globenewswire.com/NewsRoom/AttachmentNg/fdf6776f-80be-4a01-b78b-1dcc786d5051

https://www.globenewswire.com/NewsRoom/AttachmentNg/66c2fa8f-6518-4aed-988f-09d98f483a25

https://www.globenewswire.com/NewsRoom/AttachmentNg/c5ff730b-9a14-4cad-843f-696bcf80efad

https://www.globenewswire.com/NewsRoom/AttachmentNg/63807f35-1f7c-4a3c-b3c7-6fa0df9d0d83

https://www.globenewswire.com/NewsRoom/AttachmentNg/42529e33-6d14-4c03-bfc4-9ec7030a7fc6

![]()

News Provided by GlobeNewswire via QuoteMedia