Secretary of State Marco Rubio confirmed that he is now the acting director of the U.S. Agency for International Development (USAID).

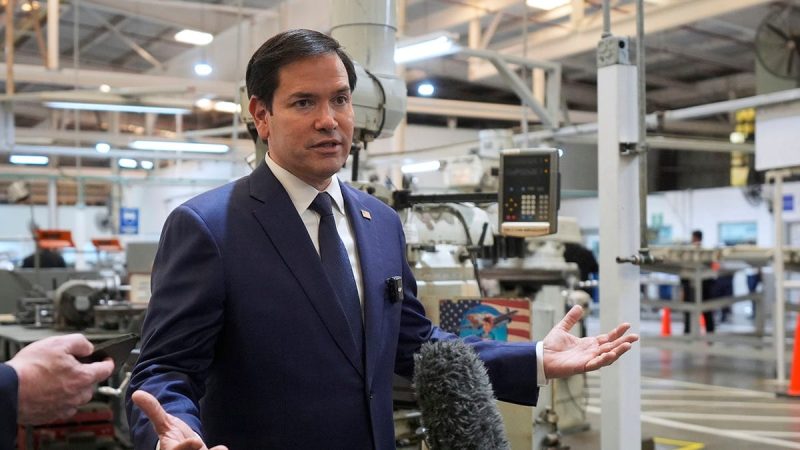

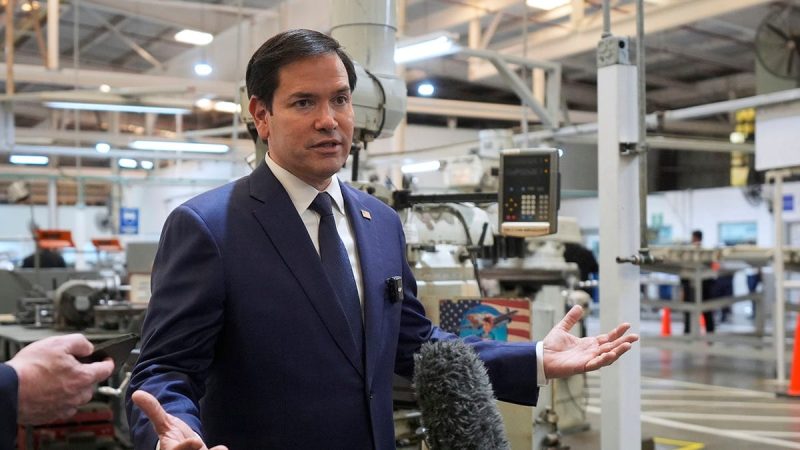

During his five-nation trip to Central America, Rubio announced the development to reporters while taking questions from the press at a maintenance firm, Aeroman, in San Luis Talpa, El Salvador.

Rubio said his frustration with USAID goes back to his time in Congress, describing the agency as ‘completely unresponsive.’ It is supposed to respond to policy directives at the State Department ‘and it refuses to do so,’ the secretary said, adding: ‘there are a lot of functions of USAID that are going to continue, that are going to be a part of American foreign policy, but it has to be aligned with American foreign policy.’

During his confirmation hearing, Rubio recalled, he said that ‘every dollar that we spend and every program that we fund will be aligned with the national interests of the United States, and USAID has a history of sort of ignoring that and deciding that they’re somehow a global charity separate from the national interest.’

‘These are taxpayer dollars. And so I’m very troubled by these reports that they have been unwilling to cooperate with people who are asking simple questions about what does this program do, who gets the money, who are our contractors, who’s funded,’ Rubio said. ‘And that sort of insubordination makes it impossible to conduct the sort of mature and serious review that I think foreign aid at large should have.’

‘We’re spending taxpayer money here. These are not donor dollars,’ Rubio continued. ‘These are taxpayer dollars, and we owe the American people the assurances that every dollar that we are spending abroad is being spent on something that furthers our national interests. And so far, a lot of the people who work at USAID have simply refused to cooperate.’

Asked if he was currently in charge of USAID, Rubio said, ‘I’m the acting director of USAID. I’ve delegated that authority to someone, but I stay in touch with him.’

‘And again, our goal was to allow our foreign aid to the national interest,’ Rubio said. ‘But if you go to mission after mission, and embassy after embassy around the world, you will often find that in many cases USAID is involved in programs that run counter to what we’re trying to do and our national strategy with that country or that region. That cannot continue. USAID is not an independent, non-governmental entity. It is an entity that spends taxpayer dollars, and it needs to spend it, as the statute says, in alignment with the policy directives that they get from the Secretary of State, the National Security Council and the president.’

‘It’s been 20 or 30 years where people have tried to reform it. And it refuses to reform, it refuses to cooperate with people. When we were in Congress we couldn’t even get answers to basic questions about programs,’ he said. ‘That will not continue.’

USAID staffers were instructed earlier Monday to stay out of the agency’s Washington headquarters after Elon Musk announced President Donald Trump had agreed with him to shut the agency.

Thousands of USAID employees already had been laid off and programs shut down in the two weeks since Trump took office. USAID staffers also said more than 600 additional employees had reported being locked out of the aid agency’s computer systems overnight. Those still in the system received emails saying that ‘at the direction of Agency leadership’ the headquarters building ‘will be closed to Agency personnel on Monday, Feb. 3.’ The agency’s website can no longer be reached.

Democratic lawmakers have protested the moves, saying Trump lacks constitutional authority to shut down USAID without congressional approval and decrying Musk’s accessing sensitive government-held information through his Trump-sanctioned inspections of federal government agencies and programs.

‘This is a corrupt abuse of power that is going on,’ Sen. Chris Van Hollen, D-Md., said at a rally with agency supporters and other Democratic lawmakers in front of the USAID building. ‘As my colleague said, it’s not only a gift to our adversaries, but trying to shut down the Agency for International Development by executive order is plain illegal.’

In the Oval Office on Monday, Trump addressed concerns about the access granted to Musk, who leads the Department of Government Efficiency.

‘Elon can’t do and won’t do anything without our approval. And we’ll give him the approval where appropriate. Where not appropriate, we won’t,’ Trump said.

Rubio traveled to El Salvador on Monday after spending two days in Panama.

Before his departure, he observed from the tarmac a repatriation flight carrying 32 men and 11 women back to Colombia after they had crossed the Darien Gap and were stopped in Panama.

The State Department said such deportations send a strong message of deterrence and that the U.S. has provided Panama with financial assistance to the tune of almost $2.7 million in flights and tickets.

‘Mass migration is one of the great tragedies in the modern era,’ Rubio said, speaking afterward in a nearby building. ‘It impacts countries throughout the world. We recognize that many of the people who seek mass migration are often victims and victimized along the way, and it’s not good for anyone.’

His trip comes amid a sweeping freeze in U.S. foreign assistance and stop-work orders that have shut down U.S.-funded programs, including in Central American countries. The State Department said Sunday that Rubio had approved waivers for certain critical programs in countries he is visiting, but details of those were not immediately available.

Trump has been threatening action against nations that will not accept flights of their nationals from the United States, and he briefly hit Colombia with penalties last week for initially refusing to accept two flights. Panama has been more cooperative and has allowed flights of third-country deportees to land and send migrants back before they reach the United States.

Panamanian President José Raúl Mulino agreed Sunday to withdraw from China’s Belt and Road development and infrastructure initiative after Rubio warned him to reduce China’s role in canal operations or face American retaliation.

‘What I expressed to President Molina, who, look, he is a friend of America,’ Rubio said later Monday from El Salvador. ‘Panama is a strong partner, an ally of the United States. As the president has articulated, when we turned over the canal, we turned it over to Panama. We didn’t turn it over to China. So you get there and the Chinese control both entries to the port.’

‘We have a treaty obligation to protect the canal if it comes under attack. But our navy is paying fees to go through there,’ he continued. ‘So I expressed frustration about those things. And again, I understand that it’s a delicate issue in Panama. We don’t want to have a hostile or a negative relationship with Panama. I don’t believe we do. But we had a frank and respectful conversation, and I hope it’ll yield fruits and result in the days to come.’

Rubio added that Panama has ‘been a great partner’ in slowing down the rate of migration coming across Darien Gap.

The Associated Press contributed to this report.

This post appeared first on FOX NEWS