(TheNewswire)

NOT INTENDED FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, BC TheNewswire – July 22, 2025 Heritage Mining Ltd. (CSE: HML FRA: Y66) (‘ Heritage ‘ or the ‘ Company ‘) is pleased to announce a non-brokered offering of up to 18,187,725 units (the ‘ LIFE Offering ‘) for gross proceeds of up to C$636,570 with a lead order from a strategic investor of ~C$450,000. The Company is also pleased to announce it has entered into an asset purchase agreement with Advanced Gold Exploration Inc. to acquire a 75% interest in the Melba Mine (a former past producer from early-mid 1900’s) which, subject to the satisfaction of conditions precedent and due diligence, will facilitate the Company’s entrance into the Kirkland Lake Gold District. The Company also provides an exploration update on its Drayton-Black Lake and Contact Bay projects.

July 2025 Corporate Update Highlights

July 2025 Exploration Update Highlights

-

Drilling at Drayton-Black Lake (‘ DBL ‘) – Zone 3 Extension confirms gold mineralization in a broad quartz vein structure as initially reported in Heritage’s press release dated May 15, 2025.

-

DBL – Zone 3 Extension drilling intersected multiple zones of locally anomalous gold mineralization in drill hole HML25-011 associated with a 46m wide quartz zone, including 0.95 g/t Au over 1m from 237.00m; and

-

Zone 3 Extension drill hole HML25-012 tested a different magnetic lineament at the periphery at the Lake of the Bays Batholith and the contact zone of this batholithic body. Two n arrow zones of up to 0.43 g/t Au over 1m were intersected.

-

Drilling at Contact Bay is completed. A total of 10 holes for 2,726m were drilled with assays pending.

‘We are pleased to welcome a new strategic shareholder, who aligns with Heritage’s view that systematic active exploration across all properties is the key driver. We look forward to generating value to all stakeholders.

The proposed Melba Mine acquisition (pending due diligence) offers the Company exposure to the well-known mining camp (Kirkland Lake and Timmins). We look forward to applying our active systemic exploration approach to this area in short order post-acquisition.

Although assays remain pending from Zone 3 Extension at DBL and Contact Bay we appreciate the technical success and confirmation of anomalous gold in a new area never before prospected in the Sioux Lookout Area. This is the broadest quartz vein ever intersected within the Sioux Lookout District and warrants further drilling and evaluation along strike.’ Commented Peter Schloo, President CEO, and Director of Heritage

2025 Corporate Update

The Company has concurrently filed an offering document in respect of the LIFE Offering (the ‘ Offering Document ‘) on its profile on SEDAR+. The following is a brief summary of the terms of the LIFE Offering but investors should review the Offering Document in detail prior to making an investment decision:

Offering:

A non- brokered ‘best-efforts basis’ private placement financing of up to 18,187,725 units (the ‘ LIFE Offering ‘) for gross proceeds of up to $635,570 for units of the Company (each, a ‘ Unit ‘) at a price of $0.035 per Unit, with each Unit being comprised of one (1) common share of the Company (each a ‘ Common Share ‘) and one (1) common share purchase warrant (a ‘ Warrant ‘) granting the holder the right to purchase one (1) additional Common Share of the Company (a ‘ Warrant Share ‘) at a price of $0.05 at any time on or before 36 months from the Closing Date (as defined herein), which securities shall be offered pursuant to the listed issuer financing exemption under Part 5A of National Instrument 45-106 – Prospectus Exemptions (‘ NI 45-106 ‘).

Offering Price:

The Offered Securities shall be offered at the price of $0.035 per Unit.

Offering Amount:

The maximum offering amount under the LIFE Offering shall be for aggregate proceeds of $636,570, assuming full subscription pursuant to the LIFE Offering and the full exercise of the Broker’s Units (as defined below). There is no minimum offering amount pursuant to the LIFE Offering .

The maximum number of securities issuable under the LIFE Offering consists of an aggregate of up to 18,187,725 Units for gross proceeds of up to $636,570.

Closing Date: The closing of the LIFE Offering (the ‘ Closing Date ‘) is expected to take place on or about July 31, 2025.

Fees and Commissions

Cash fee and broker warrants, as detailed below.

Cash Fee: The Company will pay cash fees equal to 7.0% of gross proceeds raised in respect of the Offering.

Broker Units: The Company will issue broker units (each a ‘ Broker Unit ‘) equal to 7% of the Units sold under the Offering at an exercise price equal to $0.035 per Broker Unit, with each Broker Unit consisting of one (1) Common Share and one (1) Broker Warrant, with each Broker Warrant granting the holder the right to purchase one (1) additional Common Share of the Company (each, a ‘ Warrant Share ‘).

Melba Asset Purchase Agreement Summary:

Purchase Price

-

Heritage shall issue the Vendor Common Shares having a deemed value of C$350,000 Consideration Shares ‘) at a price per Consideration Share equal to the closing price of the Common Shares in the capital of Heritage on the trading day preceding the Closing Date and subject to the following release schedule (which the Vendor hereby agrees will be reflected in restrictive legends applied to the certificates representing the Consideration Shares):

(a) 25% of the Consideration Shares released on Closing Date;

(b) 25% of the Consideration Shares released on the date that is 90 days after the Closing Date;

(c) 25% of the Consideration Shares released on the date that is 180 days after the Closing Date; and

(d) 25% of the Consideration Shares released on the date that is 270 days after the Closing Date.

Closing of the acquisition is subject to customary conditions precedent for a transaction of this nature, including the approval of the Canadian Securities Exchange.

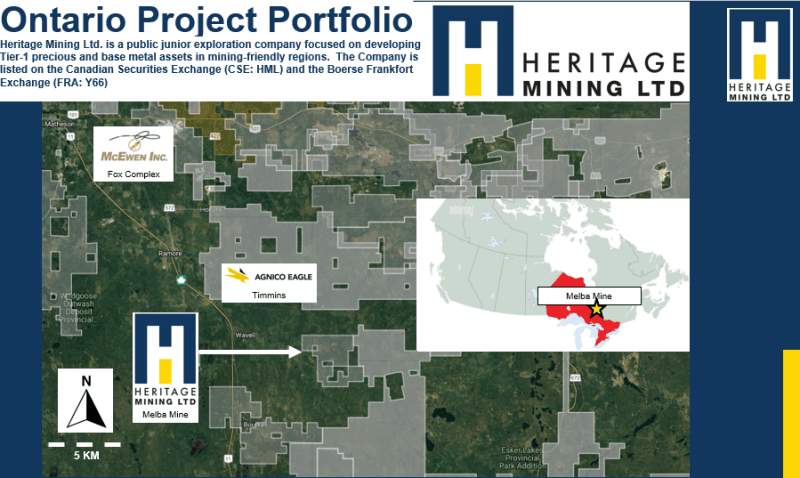

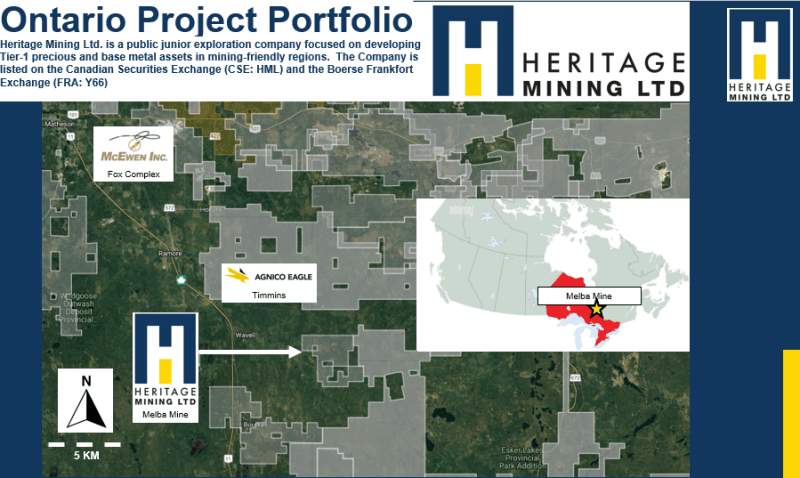

Melba Mine Property Description

The Melba Mine is located in Northwestern, Ontario, Canada Southwest of Matheson Ontario (Figure One) approximately seven kilometres west off the King’s Highway 11, on the section of highway travelling from Kirkland Lake to Cochrane. The Melba Mine is located on the west central part of Ontario close to the Ontario and Quebec border. It’s fortunate the location of the Melba Property lies within the central hub of over 100 years of mining activities, including active mining operations within the Abitibi Greenstone Belt.

The claim package includes single cell mining claims spanning 1,522.70 hectares and one mining lease.

Property Geology

The governing element of structure appears to be a contact between dioritic greenstone to the south and argillaceous greywacke to the north. The contact trends north 50-60 degrees west and dips northward. Whether the greywacke is part of a synclinal trough of sediments that are younger than the greenstone or whether it is part of a sedimentary band belonging to the greenstone series is an unknown factor at present. The greywacke is cut by dikes of porphyry that run parallel to the contact. The main gold bearing vein, usually described as the ‘Blue Vein’, also runs parallel to the contact but lies within the sediments. It strikes north 55 degrees west and dips northward 55 degrees. It is accompanied by shearing and alteration, also by a pattern of cross fracturing that has produced faulting in the main vein and has led to the development of irregular veins in the adjacent rocks. The main vein is displaced 60 feet (18.2 metres) northward near the shaft and other displacements have been found underground. The picture resembles that of the sedimentary belt in the Beatty-Munro area. Numerous feldspar porphyry, diorite and basic syenite dikes were intersected by the drilling. Overall, a significant amount of the drill core showed alteration, some highly, while carbonate stringers were numerous and visible gold was noted in drill core.

Click Image To View Full Size

Figure 1: Property Map – Melba Mine

2025 Exploration Update

Assays were delayed due to operational issues at the lab and core shack facilities; corrective measures have been implemented, and normal operations are expected to resume shortly.

Discussion of Results

DBL – Zone 3 Extension

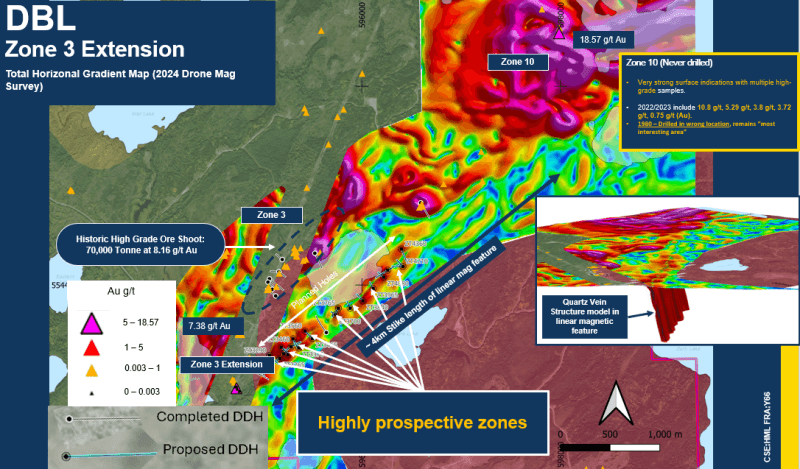

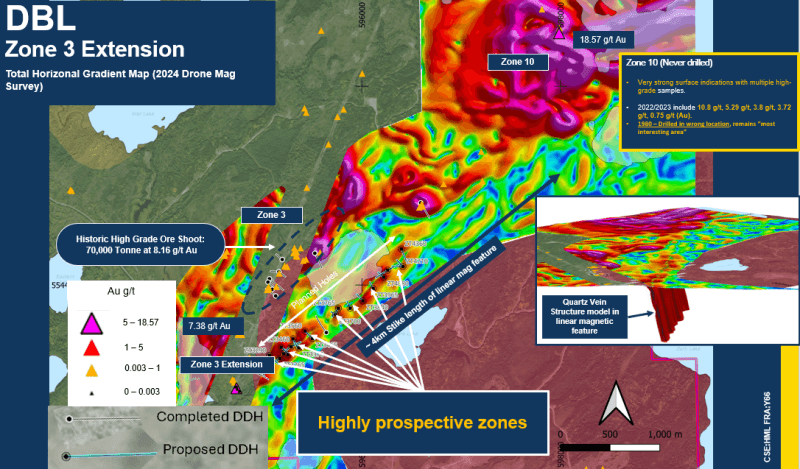

The 2025 drill program at Zone 3 Extension targeted granite-hosted mineralised quartz-vein structures that were first observed in the HML Zone 3 drilling program of August 2024 (Figure 3). The recently completed program comprised 4 holes for a total 1105.5m targeting a northeast-southwest trending magnetic lineament. Drilling is considered a technical success with two ( HML25-011 and 013 ) of the four holes intersecting a well-developed quartz vein structure, including drill hole HML25-013 that intersected a 74m wide vein structure (true width unknown). Assays received for HML25-010, 011 and 012, with assays pending for HML25-013 & 014.

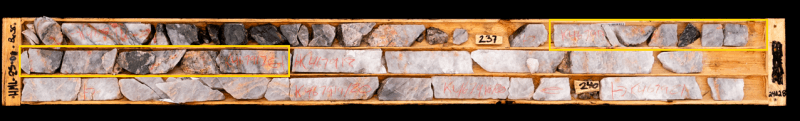

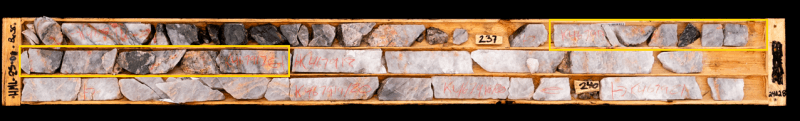

Assays for HML25-010 & 011 confirm locally elevated gold values in the vein structure, with the best intersection of 0.95g/t gold over 1 meter in drill hole HML25-011 (Figure 2). Although gold mineralization is low grade, significant exploration potential remains along strike of this well-defined linear mag feature, and further drilling is proposed to test this ‘mega-quartz vein structure’.

HML25-011 Highlights:

Click Image To View Full Size

Figure 2: HML25-011 Box 56 – Yellow Box indicates from 237.00m to 238.00m

Click Image To View Full Size

Figure 3: Showing the completed and proposed holes testing the northeast-southwest trending magnetic lineament

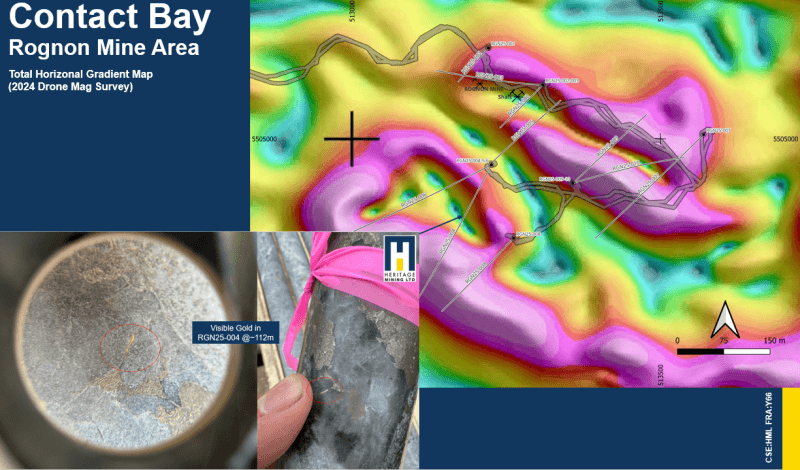

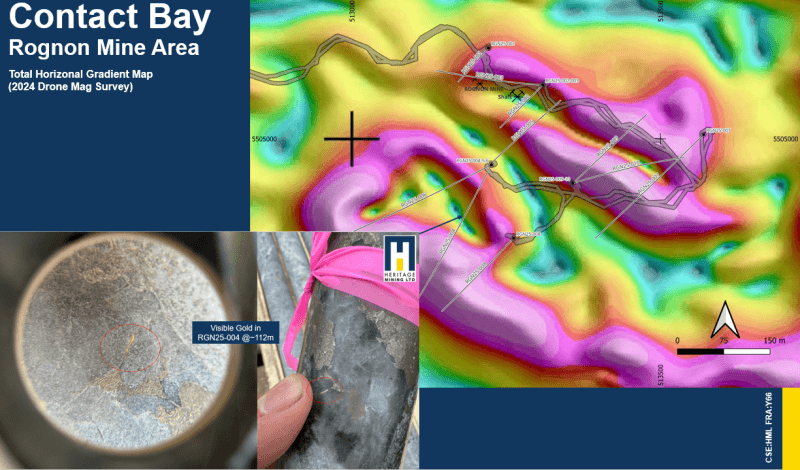

Contact Bay Rognon Mine Area

The 2025 drill program at Contact Bay is completed, targeting a mineralised quartz-vein structure that was historically mined in the early 1900’s. The recently completed program comprised 10 holes for a total 2726.0m. The geology comprises metavolcanic rocks cut by granitoid batholiths and gabbroic sills and stocks. The metavolcanic rocks are locally cut by cm-scale quartz-sulphide veins and drill hole RGN25-004 intersected visible gold in a quartz-pyrite vein (Figure 4). Assays are pending for all holes.

Click Image To View Full Size

Figure 4: Showing the magnetic map for the Contact Bay Rognon Mine area and an image of the visible gold intersected in RGN25-004.

Conclusion

Although some assays remain pending, the Company believes additional drilling is warranted to test along this major quartz vein structure along strike. The Company has proposed an additional 10 holes to test along a 2km strike length of the magnetic lineament (Figure 3).

Qualified Person

Stephen Hughes P. Geo, Strategic Advisor for the Company, serves as a qualified person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects and has reviewed the scientific and technical information in this news release, approving the disclosure herein.

Technical Program

Heritage Mining adheres to a strict QA/QC protocol for handling, sampling, sample transportation and analyses. Chain-of-custody protocols are designed to ensure security of samples until their delivery at the laboratory.

Sampling, Sub-sampling, and Laboratory Analysis for Heritage Mining Drayton Black Lake Project All drilling at the Drayton Black Lake project recovers NQ core. Drill core is systematically split in half using a diamond saw. A qualified geologist examines the drill core, marking intervals for sampling and indicating the cutting line. Sample lengths are typically 1.0 metre, adjusted to a minimum length of 0.5 metre as necessary to respect lithological and/or mineralogical contacts and to isolate narrow veins or structures that may contain higher-grade mineralization.

Technicians saw the core along the cutting lines determined by the geologist. One half of the core is retained as a witness sample, while the other half is submitted for analysis. Individual sample bags are securely sealed and placed into sealed bags, which are then clearly marked with their contents.

Heritage Mining submits samples for gold determination by PhotonAssay to ALS Canada Ltd. (‘ ALS ‘). ALS operates under a commercial contract with Heritage Mining.

Drill core samples are shipped to ALS for sample preparation at their facilities in Thunderbay Ontario. ALS is an ISO/IEC 17025:2017 accredited laboratory for the PhotonAssay method in addition to a variety of diverse metal determination methods.

Analytical Procedures

The ALS procedure for PhotonAssay involves lab applying preparation codes LOG-21 (sample logging via barcode), CRU-31 (fine crushing so that 70% passes through a 2mm screen) and SPL-32a (rotary splitting of a representative ~500g subsample) followed by analytical code Au-PA01 which is a non-destructive gold analysis method using high-energy X-rays with a gold detection range from 0.03 ppm to 350ppm.

After gold assays are returned, Heritage then may choose to perform multi-element assays on selected samples based on the gold results. In these cases, sample preparation codes FND-05 (locate and use remaining crushed material from Au-PA01) and PUL-32m (pulverization so that >85% passes 75 µm screen) are then applied followed by analytical code ME-MS61 (multi-element ICP-MS analysis for base metals, pathfinder elements, lithophile elements and rare earth elements).

________________________________________

Quality Assurance/Quality Control (QA/QC)

The drill program design, QA/QC, and interpretation of results are performed by qualified persons employing a rigorous QA/QC program consistent with industry best practices. Standards and blanks account for a minimum of 10% of the samples, in addition to the laboratories’ internal quality assurance programs.

Quality Control data are meticulously evaluated upon receipt from the laboratories for any failures. Appropriate corrective action is taken if assay results for standards and blanks fall outside allowed tolerances. All results disclosed by Heritage Mining have successfully passed the Company’s stringent quality control protocols.

The Company does not recognize any factors of drilling, sampling, or recovery that could materially affect the accuracy or reliability of the assay data disclosed. The assay data disclosed in this press release have been verified by the Company’s Qualified Person against the original assay certificates.

Heritage Mining notes that it has not completed any economic evaluations of its Drayton-Black Lake Project, and the project does not currently have any resources or reserves.

ABOUT HERITAGE MINING LTD.

The Company is a Canadian mineral exploration company advancing its two high grade gold-silver-copper projects in Northwestern Ontario. The Drayton-Black Lake and the Contact Bay projects are located near Sioux Lookout in the underexplored Eagle-Wabigoon-Manitou Greenstone Belt . Both projects benefit from a wealth of historic data, excellent site access and logistical support from the local community.

For further information, please contact:

Heritage Mining Ltd.

Peter Schloo, CPA, CA, CFA

President, CEO and Director

Phone: (905) 505-0918

Email: peter@heritagemining.ca

FORWARD-LOOKING STATEMENTS

This news release contains certain statements that constitute forward looking information within the meaning of applicable securities laws. These statements relate to future events of the Company. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as ‘seek’, ‘anticipate’, ‘plan’, ‘continue’, ‘estimate’, ‘expect’, ‘forecast’, ‘may’, ‘will’, ‘project’, ‘predict’, ‘potential’, ‘targeting’, ‘intend’, ‘could’, ‘might’, ‘should’, ‘believe’, ‘outlook’ and similar expressions are not statements of historical fact and may be forward looking information. All statements, other than statements of historical fact, included herein are forward-looking statements.

Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks include, among others, the inherent risk of the mining industry; adverse economic and market developments; the risk that the Company will not be successful in completing additional acquisitions; risks relating to the estimation of mineral resources; the possibility that the Company’s estimated burn rate may be higher than anticipated; risks of unexpected cost increases; risks of labour shortages; risks relating to exploration and development activities; risks relating to future prices of mineral resources; risks related to work site accidents, risks related to geological uncertainties and variations; risks related to government and community support of the Company’s projects; risks related to global pandemics and other risks related to the mining industry. The Company believes that the expectations reflected in such forward-looking information are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward‐looking information should not be unduly relied upon. These statements speak only as of the date of this news release. The Company does not intend, and does not assume any obligation, to update any forward‐looking information except as required by law.

This document does not constitute an offer to sell, or a solicitation of an offer to buy, securities of the Company in Canada, the United States, or any other jurisdiction. Any such offer to sell or solicitation of an offer to buy the securities described herein will be made only pursuant to subscription documentation between the Company and prospective purchasers. Any such offering will be made in reliance upon exemptions from the prospectus and registration requirements under applicable securities laws, pursuant to a subscription agreement to be entered into by the Company and prospective investors.

Copyright (c) 2025 TheNewswire – All rights reserved.