The Company is advancing the NICO Project toward a construction decision with U.S. & Canadian Government financial support from critical minerals supply chain security programs

Fortune Minerals Limited (TSX: FT) (OTCQB: FTMDF) (‘ Fortune ‘ or the ‘ Company ‘) ( www.fortuneminerals.com ) is pleased to provide an update of ongoing work on the vertically integrated NICO cobalt-gold-bismuth-copper critical minerals project in Canada (‘ NICO Project ‘). The NICO Project is comprised of a planned mine and concentrator in the Northwest Territories (‘ NWT ‘) and a hydrometallurgical processing facility in Lamont County, Alberta where concentrates from the mine, and other feed sources, will be processed to value-added products needed for the energy transition, new technologies and defense. Fortune has been awarded ~C$17 million of non-dilutive contribution funding from the U.S. Department of Defense (‘ DoD ‘), Natural Resources Canada (‘ NRCan ‘), and Alberta Innovates to help finance the work needed to bring the NICO Project to a project finance and construction decision (see news releases dated, December 5, 2023, and May 16, 2024). Development of the NICO Project would provide a reliable North American supply of cobalt sulphate, gold doré, bismuth ingots, and copper precipitate enhancing domestic supply chains for three metals identified on the Canadian and U.S. Government critical minerals lists and a highly liquid and countercyclical gold co-product to mitigate metal price volatility.

Like our news? Click-to-post on X .

Highlights

- New comminution & flotation circuit designs to reduce capital & operating costs

- Concentrator modifications to improve gold, bismuth & cobalt recoveries

- Smaller hydrometallurgical bismuth circuit with lower capital costs & higher recoveries

- Successful leaching & cementation of blended Rio Tinto & Fortune bismuth streams

Feasibility Study Update

Fortune retained Worley Canada Services Ltd. (‘ Worley ‘) to lead the engineering for an updated Feasibility Study assessing the economics of the NICO Project at current costs and commodity prices. Worley is also assisting Fortune with permitting for the brownfield site in Lamont County, Alberta where the Company plans to construct its hydrometallurgical facility. The NICO Project was previously assessed in a positive Feasibility Study by Micon International Limited (‘ Micon ‘) in 2014 but is now out of date. Micon, P&E Mining Consultants Inc. (‘ P&E ‘) and WSP Golder, who participated in the 2014 study, are also engaged to assist Worley with preparation of the updated study and NI 43-101 Technical Report. The Feasibility Study is being supported with funding from the U.S. DoD and NRCan’s Global Partnerships Initiative (‘ GPI ‘) contribution funding.

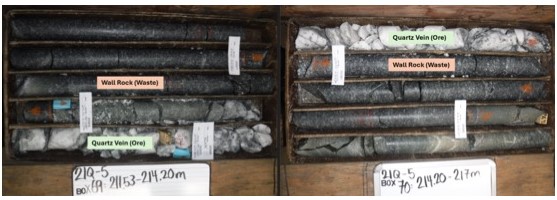

The updated Feasibility Study will incorporate a number of improvements to the NICO Project identified by Fortune and Worley to deliver a more financially robust development. These include: the superior brownfield Alberta hydrometallurgical facility site with existing buildings; the new Tlicho Highway to Whati, NWT; a new geological block model with more constrained ore zone boundaries to reduce modelling dilution and better differentiate high-grade resource blocks for earlier processing; a new mine plan and production schedule with a stockpiling strategy to accelerate the processing of higher margin ores and reduce near-surface waste rock stripping; better equipment choices; and process optimizations from recent test work.

Worley has completed value enhancement studies improving the grinding and comminution, and flotation circuits for the planned concentrator in the NWT. A High-Pressure Grinding Rolls (‘ HPGR ‘) and vertical mills will replace parts of the previously designed circuit and ball mill with an anticipated ~C$7 million reduction in capital costs and ~C$1.3 million reduction in annual operating costs from a smaller plant footprint utilizing more energy efficient equipment. HPGR variability tests are in progress at SGS Canada Inc. (‘ SGS ‘) in Lakefield, Ontario to provide additional data for the detailed design.

Worley has also reviewed the Company’s historical flotation test work and piloting information and has identified opportunities using Jameson flotation cells to recover additional fine, 5- to 20-micron sized gold and bismuth particles contained in NICO deposit ores. Jameson cell tests were completed at SGS at a finer (minus 44-micron) grind size and the Company is pleased to report that these tests have confirmed an improvement in gold, bismuth and cobalt recoveries for the concentrator. A carbon column is also being designed into the secondary flotation circuit to capture the ~5% of contained gold that previously would have been dissolved and lost in the process water during bismuth and cobalt separation. Fortune is also investigating other options to reduce potential gold losses during the processing of high-grade, gold-rich ores.

Worley has also completed a minor realignment of the NICO access road design to reduce construction costs and has also completed the process flow diagrams, piping and instrumentation diagrams, and mass balance for the NWT concentrator. As part of the ongoing Feasibility Study improvements, Worley is also working on updated concentrator and hydrometallurgical facility designs to advance the vertically integrated development.

Test Work Update

Fortune collected between 15 and 16 metric tonnes of ores from its earlier test mining stockpiles at the NICO mine site and shipped this material to SGS for metallurgical test work and piloting. The test work is being financially supported with contribution funding from NRCan’s GPI and a $715,000 award in 2023 from the Critical Minerals Research Development and Demonstration (‘ CMRDD ‘), with additional financial support coming from Alberta Innovates’ Clean Resources Continuous Intake Program and the U.S. DoD. Phase 2 of the program, consisting of crushing, grinding and bulk and secondary flotation was successfully completed in Q3, 2024, producing gold-bearing cobalt and bismuth concentrates for hydrometallurgical testing.

The Phase 3 hydrometallurgical work is in progress and the results achieved to date are exceeding the Company’s expectations. Ferric chloride leaching of bismuth concentrate followed by cementation and purification test work achieved 97% bismuth recoveries, producing a cement grading up to 95% bismuth, and averaging about 0.2% iron as the main impurity. The data was used to support the bismuth circuit process design criteria on the basis of a 66% reduction of the leaching residence time, from three hours to one hour. Overall, the design criteria are predictive of a significant material reduction in the size, capital and operating costs for the bismuth circuit for the hydrometallurgical plant. The results are also predictive of about a 2% higher bismuth recovery than initially estimated for the bismuth leaching and cementation circuits. Fortune has retained XPS Industry Relevant Solutions to conduct the smelting and refining parts of the bismuth test work and complete the design of the bismuth pyrometallurgical circuit.

A preliminary pressure oxidation (‘ POX ‘) test on the cobalt concentrate was recently completed, but more comprehensive cobalt processing tests will be carried out in the first quarter of 2025. The cobalt test work will also include a value enhancement optimization of sequential gypsum precipitation to validate the production of a gypsum by-product from the autoclave effluent. If successful, a saleable gypsum by-product would provide a material improvement to the hydrometallurgical facility overall revenues and reduce waste disposal costs for the process residue.

Rio Tinto Process Collaboration

Fortune has a process collaboration agreement with Rio Tinto investigating the feasibility of recovering additional cobalt and bismuth at the Alberta hydrometallurgical facility by processing precipitates produced from Kennecott smelter wastes in Utah. Rio Tinto successfully generated a high-grade bismuth oxychloride intermediate from its Utah process streams and shipped samples of this material to SGS for testing using Fortune’s process criteria as well as blending with NICO bismuth concentrates. Leaching and cementation tests carried out on the Rio Tinto material blended with NICO bismuth concentrate were very successful, validating no material change in bismuth recoveries or metallurgical performance relative to treating unblended NICO bismuth concentrate. The feasibility of processing Rio Tinto material at the Alberta Hydrometallurgical facility has therefore been confirmed and additional work is planned by both companies to advance the collaboration. These blending validation studies are financially supported by NRCan’s GPI contribution funding and the U.S. DoD.

About the NICO Project

Fortune has expended approximately C$140 million to advance the NICO Project from an in-house mineral discovery to a near construction-ready development. The Company has secured the environmental assessment approval and the major mine permits for the facilities in the NWT and the municipal planning approvals for the Alberta hydrometallurgical facility. Additional permitting is required at both sites and is in progress with partial funding support from the U.S. DoD.

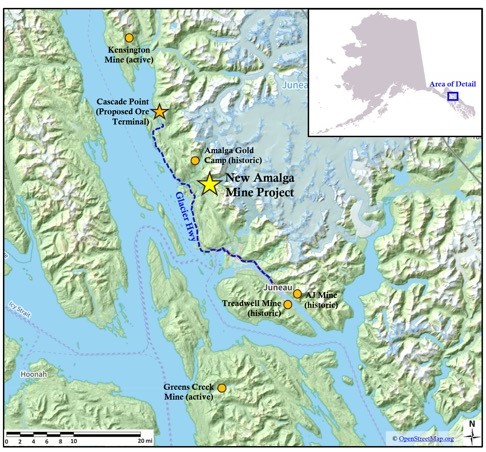

The NICO deposit and planned mine is situated in Tlicho Territory, approximately 160 km northwest of the City of Yellowknife and 50 km north of the community of Whati where the new Tlicho Highway currently terminates. A spur road from Whati is planned as part of the development to enable trucking concentrates to the railhead at Enterprise, NWT for delivery to Alberta and downstream processing.

The NICO deposit contains open pit and underground Proven and Probable Mineral Reserves totaling 33.1 million tonnes containing 1.11 million ounces of gold, 82.3 million pounds of cobalt, 102.1 million pounds of bismuth, and 27.2 million pounds of copper to support a ~20-year mine life. Fortune also owns the Sue-Dianne satellite copper deposit located 25 km north of the NICO deposit and is a potential future source of incremental mill feed for the Company’s planned concentrator. NICO and Sue-Dianne are iron oxide copper-gold (‘ IOCG ‘)-type mineral deposits with world class global analogues that support the exploration potential of the area and Fortune’s properties.

Ores from the NICO deposit will be mined primarily by open pit methods with a low waste to ore strip ratio. Portions of the higher-grade Mineral Reserves would be mined by underground open stoping methods to accelerate cash flows during early years of the mine life using the existing ramp and underground workings for access and ore haulage.

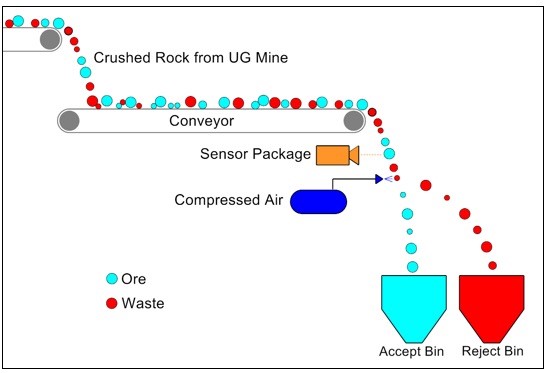

NICO ores will be processed in a concentrator constructed at the mine site with a 4,650 metric tonnes per day mill throughput rate and a low (4%) mass pull during bulk flotation that captures the recoverable metals in only 180 tonnes of bulk concentrate per day. A very efficient secondary flotation process separates the ore minerals into gold-bearing cobalt and bismuth concentrates for low-cost transportation by truck and rail to Alberta.

The hydrometallurgical facility is planned to be constructed in Lamont County in Alberta’s Industrial Heartland, approximately 50 km northeast of Edmonton. Cobalt concentrate will be processed by POX in an autoclave to dissolve the contained metals, followed by sequential neutralization, copper cementation, and solvent extraction purification and crystallization of cobalt sulphate heptahydrate. The bismuth concentrate will be processed by ferric chloride leaching, followed by cementation, and smelting to 99.995% bismuth ingots. Gold will be recovered by leaching the combined autoclave residue, followed by carbon elution and smelting to doré bars.

Development of the NICO Project would provide a reliable, vertically integrated domestic supply of cobalt, gold, bismuth and copper with supply chain transparency and custody control of the metals from ores through to the production of value-added products. Fortune’s cobalt production is targeting the lithium-ion rechargeable battery industry for use in electric vehicles, portable electronics and stationary energy storage cells. The NICO deposit contains 12% of global bismuth reserves and the ingots produced by Fortune will be marketed for automotive glass and steel coatings, low melting temperature and dimensionally stable alloys, and an environmentally safe and non-toxic replacement for lead in brass, solder, steel, aluminum and galvanizing alloys, paint, radiation shielding, ceramic glazes, ammunition and fishing weights. New applications also include environmentally safe plugs to properly seal decommissioned oil and gas wells, magnets for EV powertrains, and alloys used in the nuclear and defense industries. Notably, gold, bismuth and copper prices have all been increasing and compensate for the short-term weakness in the cobalt price.

For more detailed information about the NICO Mineral Reserves and certain technical information in this news release, please refer to the Technical Report on the NICO Project, entitled ‘Technical Report on the Feasibility Study for the NICO-Gold-Cobalt-Bismuth-Copper Project, Northwest Territories, Canada’, dated April 2, 2014 and prepared by Micon International Limited which has been filed on SEDAR and is available under the Company’s profile at www.sedar.com .

The disclosure of scientific and technical information contained in this news release have been approved by Robin Goad, M.Sc., P.Geo., President and Chief Executive Officer of Fortune and Alex Mezei, M.Sc., P.Eng. Fortune’s Chief Metallurgist, who are ‘Qualified Persons’ under National Instrument 43-101.

About Fortune Minerals

Fortune is a Canadian mining company focused on developing the NICO cobalt-gold-bismuth-copper project in the Northwest Territories and Alberta. Fortune also owns the satellite Sue-Dianne copper-silver-gold deposit located 25 km north of the NICO deposit and is a potential future source of incremental mill feed to extend the life of the NICO concentrator.

Follow Fortune Minerals:

Click here to subscribe to Fortune’s email list.

Click here to follow Fortune on LinkedIn.

@FortuneMineral on X.

This press release contains forward-looking information and forward-looking statements within the meaning of applicable securities legislation. This forward-looking information includes statements with respect to, among other things, the exercise of the option by the Company and the purchase of the JFSL site, the construction of the proposed Hydrometallurgical Facility at the JFSL site, the potential for expansion of the NICO Deposit and the Company’s plans to develop the NICO Project. Forward-looking information is based on the opinions and estimates of management as well as certain assumptions at the date the information is given (including, in respect of the forward-looking information contained in this press release, assumptions regarding: the successful completion of the Company’s due diligence investigations on the JFSL site, the Company’s ability to secure the necessary financing to fund the exercise of the option and complete the purchase of the JFSL site, the Company’s ability to complete construction of a NICO Project Hydrometallurgical Facility; the Company’s ability to arrange the necessary financing to continue operations and develop the NICO Project; the receipt of all necessary regulatory approvals for the construction and operation of the NICO Project and the related Hydrometallurgical Facility and the timing thereof; growth in the demand for cobalt; the time required to construct the NICO Project; and the economic environment in which the Company will operate in the future, including the price of gold, cobalt and other by-product metals, anticipated costs and the volumes of metals to be produced at the NICO Project). However, such forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. These factors include the risks that the 2021 drill program may not result in a meaningful expansion of the NICO Deposit, the Company may not be able to complete the purchase of the JFSL site and secure a site for the construction of a Hydrometallurgical Facility, the Company may not be able to finance and develop NICO on favourable terms or at all, uncertainties with respect to the receipt or timing of required permits, approvals and agreements for the development of the NICO Project, including the related Hydrometallurgical Facility, the construction of the NICO Project may take longer than anticipated, the Company may not be able to secure offtake agreements for the metals to be produced at the NICO Project, the Sue-Dianne Property may not be developed to the point where it can provide mill feed to the NICO Project, the inherent risks involved in the exploration and development of mineral properties and in the mining industry in general, the market for products that use cobalt or bismuth may not grow to the extent anticipated, the future supply of cobalt and bismuth may not be as limited as anticipated, the risk of decreases in the market prices of cobalt, bismuth and other metals to be produced by the NICO Project, discrepancies between actual and estimated Mineral Resources or between actual and estimated metallurgical recoveries, uncertainties associated with estimating Mineral Resources and Reserves and the risk that even if such Mineral Resources prove accurate the risk that such Mineral Resources may not be converted into Mineral Reserves once economic conditions are applied, the Company’s production of cobalt, bismuth and other metals may be less than anticipated and other operational and development risks, market risks and regulatory risks. Readers are cautioned to not place undue reliance on forward-looking information because it is possible that predictions, forecasts, projections and other forms of forward-looking information will not be achieved by the Company. The forward-looking information contained herein is made as of the date hereof and the Company assumes no responsibility to update or revise it to reflect new events or circumstances, except as required by law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250108515555/en/

Fortune Minerals Limited

Troy Nazarewicz

Investor Relations Manager

info@fortuneminerals.com

Tel: (519) 858-8188

www.fortuneminerals.com