Skyharbour Resources Ltd . (TSX-V: SYH ) (OTCQX: SYHBF ) (Frankfurt: SC1P ) (‘Skyharbour’ or the ‘Company’), is pleased to announce that it has acquired, through inexpensive online staking, 21 new prospective uranium exploration claims in northern Saskatchewan. This strategic addition increases the Company’s total land position to 616,939 hectares (1,524,489 acres) across 37 projects in which it holds an interest. The newly staked claims, which are 100% owned by Skyharbour, adds to the Company’s existing portfolio of uranium projects within the Athabasca Basin, which is renowned for hosting the highest-grade uranium deposits globally and consistently ranked as a top-tier mining jurisdiction by the Fraser Institute.

While Skyharbour continues to focus on its co-flagship Russell Lake and Moore uranium projects, the newly acquired claims will be incorporated into the Company’s growing prospect generator business model. Skyharbour will actively seek strategic partners to advance these additional assets through earn-in and joint venture agreements.

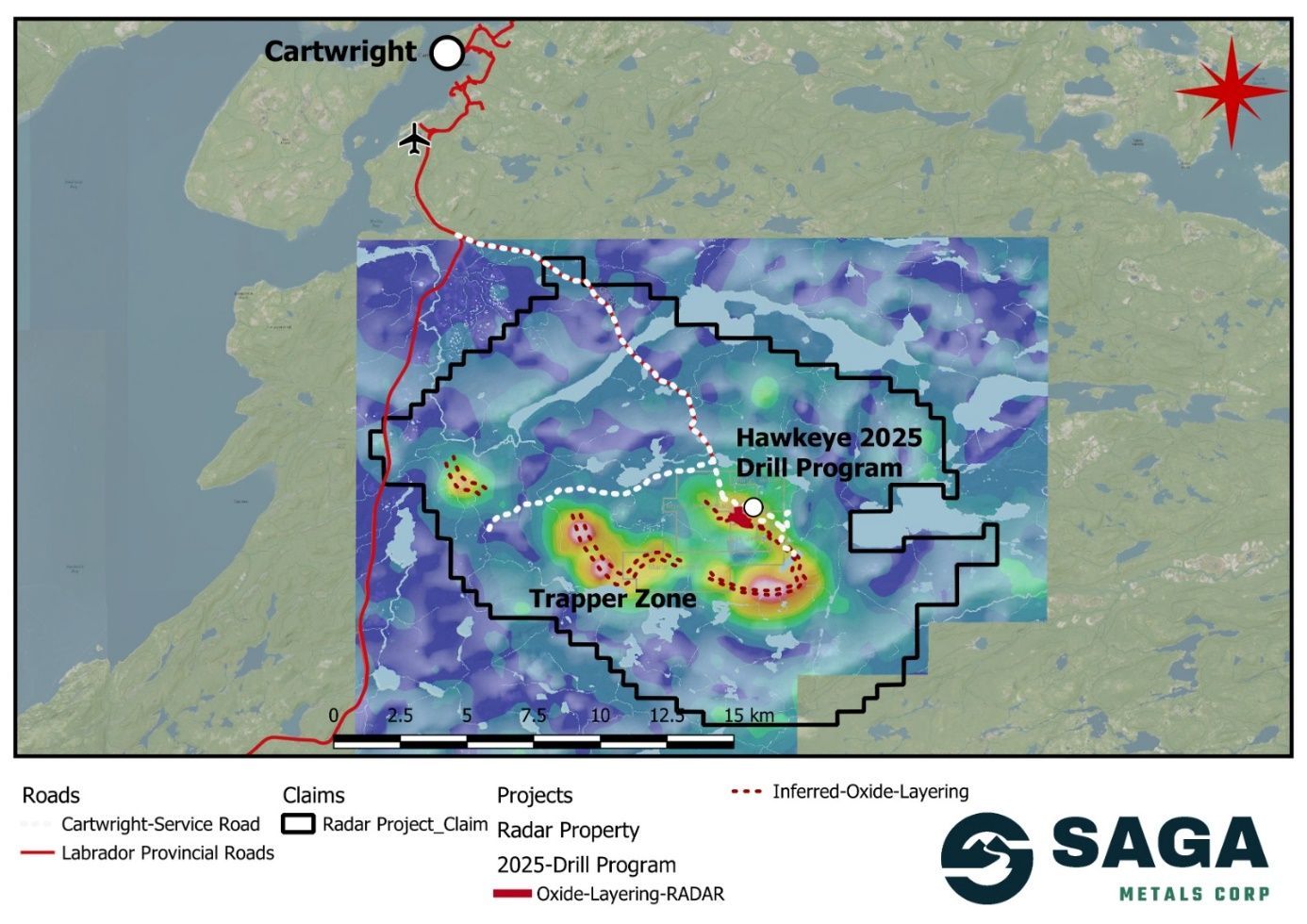

Skyharbour’s New Uranium Project Portfolio Map:

https://skyharbourltd.com/_resources/news/SKY_SaskProject_Locator_2025_07_16_v2.jpg

List of New Claims:

- Haultain Project – New project, five new claims totalling 6,607 ha

- Bonville Project – New project, comprising one new claim totalling 1,497 ha

- Bolt Extension Project – Four new claims totalling 1,127 ha, adjacent to the existing Bolt Project

- South Preston – One new claim totalling 956 ha adjacent to Skyharbour’s existing Preston JV

- Tarku Project – One new claim totalling 3,233 ha, adjacent to Skyharbour’s existing South Dufferin Project

- Elevator Project – Two newly re-staked claims totalling 8,012 ha

- 914 Project – Three newly re-staked claims totalling 1,133 ha

- Bennett Project – Two newly re-staked claims, adding 5,033 ha to the project

- Spence Project – Two newly re-staked claims totalling 11,915 ha

- Yurchison Project – One re-staked claim totalling 3,278 ha

Summary of Recently Staked Properties Available for Option:

Haultain Project:

The Haultain Project comprises five newly staked claims totalling 6,607 hectares, located approximately 46 km southwest of Cameco’s Key Lake Operation and 3 km west of Highway 914. Situated in the Mudjatik Domain just outside the currently mapped extent of the Athabasca Basin, the property is predominantly underlain by orthogneisses with historical EM conductors and coincident magnetic lows possibly indicating the presence of graphitic pelitic gneisses on the property. Limited modern exploration has been conducted on the Haultain Project beyond early-stage prospecting, mapping, and geochemical sampling. The project is prospective for basement-hosted unconformity-related uranium mineralization, as well as pegmatite-hosted U-Th-REE mineralization.

Haultain Project Map:

https://skyharbourltd.com/_resources/news/Sky_Haultain_2025_07.jpg

Bonville Project:

The Bonville Project consists of a single newly staked claim totalling 1,497 ha and is located approximately 60 km south of Cameco’s Key Lake Operation. The Bonville project is located in the Wollaston Domain outside of the currently mapped extent of the Athabasca Basin and mapping indicates the property is underlain by predominantly Wollaston Supergroup metasedimentary gneisses, including prospective locally graphitic lower Wollaston Supergroup pelitic gneisses. Historical exploration includes airborne magnetic and EM surveys, geochemical sampling, and prospecting dating back to the 1960’s and 1970’s. The property hosts three minor copper occurrences (Bonville Lake Cu, SMDI 989). It is considered prospective for basement-hosted uranium mineralization, as well as pegmatite-hosted U-Th-REE and sediment-hosted copper mineralization.

Bonville Project Map:

https://skyharbourltd.com/_resources/news/Sky_Bonville_2025_07.jpg

Bolt Extension Project:

The Bolt Extension Project comprises four newly staked claims adjacent to Skyharbour’s Bolt Project, currently under option to UraEx Resources. Mapping conducted in the 1970’s and 1980’s shows a north-south-trending, anastomosing package of amphibole gneisses surrounded by felsic gneisses, metamorphosed to granulite or upper amphibolite grade. Given the age and scale of the historical geological mapping, the area’s structural and lithological complexity is likely underestimated. Past work includes airborne and ground geophysics, as well as lake sediment and water sampling. Recent exploration between 2008 and 2018 identified multiple EM conductors, magnetic lows, and faults that extend onto the Bolt Extension claims. These features highlight the property’s strong potential to host basement-hosted unconformity-related uranium mineralization, as well as pegmatite-hosted U-Th-REE mineralization.

South Preston:

The South Preston Project consists of one claim totalling 965 hectares, located approximately 30 km south of the Athabasca Basin and adjacent to Skyharbour and Orano Canada’s Preston Joint Venture. It is underlain by Taltson felsic granulites and Cretaceous Manville Group sandstones and mudstones. Exploration to date has been limited, comprising airborne EM, magnetic, and radiometric surveys, along with limited prospecting and geological mapping. A series of EM conductors extend onto the property from the adjacent Preston JV but remain untested by drilling.

Tarku Project:

The Tarku Project consists of two claims, including one newly staked claim, totalling 5,878 ha and is located adjacent to Skyharbour’s South Dufferin Project, currently under option to UraEx Resources. The property covers the southern extension of the Virgin River Shear Zone, which hosts high-grade uranium mineralization at Cameco’s Dufferin Lake zone, approximately 32 kilometres to the north, with drill results of 1.73% U 3 O 8 over 6.5 metres, and the Centennial deposit, approximately 47 kilometres to the north, which includes intersections up to 8.78% U 3 O 8 over 33.9 metres.

Historical exploration on the property includes airborne EM, magnetic, and radiometric surveys, lake water and sediment sampling, prospecting, ground-truthing of anomalies, geological mapping, and diamond drilling. The project offers strong potential for basement-hosted, unconformity-related uranium mineralization along the Virgin River Shear Zone trend.

914 and Elevator Projects:

The 914 and Elevator projects consist of five recently re-staked, non-contiguous claims totalling 9,145 hectares, located 35 to 55 km south of Cameco’s Key Lake Operation. Both projects lie near Provincial Highway 914, providing access to southern Saskatchewan. The 914 Project, comprising three claims totalling 1,133 hectares, is situated 1 km east of the highway, while the Elevator Project, with two claims totalling 8,012 hectares, lies 15 km east.

Geological mapping in the area indicates that both projects are underlain by prospective Wollaston Supergroup metasedimentary gneisses and Archean granitic to tonalitic gneisses of the Western Wollaston Domain, known to host significant basement-hosted unconformity-related uranium mineralization further north in the Basin.

Extensive historical exploration in the 1970’s included magnetic, gravity, and EM surveys, as well as geological mapping, prospecting, and boulder and sediment sampling. Modern work has been limited, consisting of partial airborne VTEM coverage, light ground prospecting, and lake sediment sampling. All five claims are positioned along the margins of regional-scale fold structures, with recent airborne magnetic data revealing additional geological complexity not captured in earlier mapping. Multiple uranium and REE showings exist in the surrounding area around the claims. The same basement rocks found on the 914 and Elevator projects host both unconformity-related and pegmatite-hosted uranium, thorium, and REE mineralization elsewhere in the region.

Bennett Project:

The Bennett Project comprises four claims totalling 11,815 hectares, including two newly re-staked claims covering 5,033 hectares, located in the Highrock Lake area. The property is underlain by Wollaston Group metasedimentary gneisses, predominantly psammitic to meta-arkosic, locally with pelitic to psammopelitic gneisses concentrated in fold noses.

Uranium exploration was previously conducted on the property between the late 1960’s and early 1980’s, including airborne EM, magnetics, and radiometrics, radon surveys, prospecting, geological mapping, and lake water and sediment sampling. As this work predates modern geophysics and exploration models, additional targets likely remain untested. The project is considered prospective for both unconformity-related and pegmatite-hosted uranium mineralization.

Spence Project:

The Spence Project comprises five non-contiguous claims totalling 14,334 hectares, including two newly staked claims covering 11,915 ha. Located 75 to 85 km south of Cameco’s Rabbit Lake Operation, the project is easily accessible via Highway 905, which runs within 1 km of the westernmost claims and nearby infrastructure, including fuel and lodging at km 147. The project is underlain by Wollaston Supergroup metasedimentary gneisses, including graphitic pelitic units adjacent to Archean granites within the Eastern Wollaston Domain, which is a setting highly prospective for unconformity-related uranium mineralization in the Athabasca Basin.

Historical work on the property (1960’s–1990’s) focused on SEDEX-style Pb-Zn mineralization, targeting extensions of the adjacent George Lake deposit, and included airborne and ground geophysics, mapping, and geochemistry. More recently, VTEM, VLF-EM, magnetics, and radiometrics were flown in 2022–2023. Despite this, modern uranium-focused exploration has been limited. The property hosts several untested targets prospective for both unconformity-related basement-hosted uranium and SEDEX-style Pb-Zn mineralization.

Yurchison Project:

The drill-ready Yurchison Project comprises two contiguous claims totalling 9,073 hectares in the Wollaston Domain of northern Saskatchewan, including one newly re-staked claim, comprising 3,728 hectares. The claims cover an extensive package of Wollaston Supergroup metasediments in an area known for its base metal and uranium potential. The property is along trend to the north-northeast of the Janice Lake sediment-hosted Cu deposit and numerous other base metal showings in the ‘Wollaston Copperbelt’. Access to the area is greatly enhanced by Highway 905, located approximately 2 km east of the property. Grid power is also available nearby, along with a motel, restaurant and gas bar located at km 147 on Highway 905, a few km north of Courtenay Lake.

The Yurchison project has undergone a variety of exploration programs, including diamond drilling, sampling and relogging of historical holes, and Wacker drill overburden till sampling, as well as various prospecting and geophysical programs. However, most of the property remains underexplored. The majority of the work on the property was completed before 2000, with minimal follow-up since then. There are several uranium, molybdenum, and thorium showings on the project, which remains highly prospective for both basement-hosted uranium, pegmatite U-Th-REE, and/or sediment-hosted Cu-Pb-Zn mineralization.

Summary of Other Projects Available for Option:

Skyharbour continues to successfully advance its prospect generator model, growing its landholdings and progressing early-stage uranium projects through strategic partnerships. These assets offer attractive, turn-key opportunities for joint venture and earn-in partners, and the Company is actively seeking new partners to advance them going forward.

Foster Project:

The drill-ready Foster property consists of 19 claims totalling 13,938 hectares, approximately 20 km southeast of Cameco’s Key Lake operation and adjoining the southwestern end of Skyharbour’s Falcon Project, which is currently optioned to North Shore Uranium. The Foster claims are situated in the Wollaston Domain just outside of the currently mapped extent of the Athabasca Basin, with several small outliers of sandstone located regionally in the area. The basement geology consists of Wollaston Supergroup psammopelite, calc-silicate, diorite, pelitic gneiss and graphitic pelitic gneiss, accompanied by minor felsic orthogneisses.

Foster Project Map:

https://skyharbourltd.com/_resources/news/Sky_Foster_2025_07.jpg

The Foster Project contains numerous uriniferous occurrences, with the two most significant being the Great Plains Showing and the Red October Zone. At the Great Plains Showing, intense alteration and shearing in association with vein-hosted pitchblende mineralization were discovered during early exploration in the area between the 1960’s and 1980’s. A comprehensive follow-up was recommended but failed to occur due to changing uranium market fundamentals post-discovery. Another mineralized zone, the Red October Zone, was discovered in 2008 by Eagle Plains and consists of a 400 m intermittent uranium and REE-mineralized outcrop within a 1 km coincident soil geochemical and ground magnetic anomaly. The Red October Zone was drill-tested in 2012, with all six holes encountering anomalous uranium and REEs.

Elsewhere on the broader property package, prospective graphitic pelitic gneiss packages are exposed at the surface, and there are several other uraniferous occurrences, which often also host elevated REEs and/or thorium. Samples collected on the property returned up to 657 ppm U, 6,644 ppm TREE, and 344 ppm Th. Significant untested potential exists on the Foster project for basement-hosted, unconformity-related uranium deposits like those further to the north in the Wollaston Domain, like Eagle Point, Rabbit Lake and Key Lake, as well as for additional pegmatite-hosted uranium, thorium, and REE mineralization. The project is drill-ready, with numerous untested and highly prospective targets remaining.

Brassy Project:

The Brassy Project comprises two claims covering 9,896 hectares. The claims are underlain by the Athabasca Group sandstones, with thicknesses ranging from less than 80 metres to just over 200 metres. Several historical and modern EM conductors are present on the property, situated along trend of EM conductors extensively drill tested by SMDC, JNR Resources Inc., and ALX Resources Corp. on the adjacent Newnham property.

The Brassy project underwent a variety of geophysical surveys, prospecting, geochemical surveys, and geological mapping between 1969 and 1983, followed by a multi-decade pause in exploration due to poor uranium market conditions. Between 2005 and 2011, improved market conditions led to portions of the Brassy project being covered by modern EM, magnetics, radiometrics, and gravity surveys. However, no modern ground exploration has been conducted to date. The property remains highly prospective for unconformity-related uranium mineralization.

Orr Project:

The Orr project comprises one claim totalling 5,987 ha located in the northern Athabasca Basin, approximately 46 km southeast of the community of Black Lake. The project is underlain by approximately 160 to 320 metres of Athabasca Group sandstones and conglomerates, which overlie the Mudjatik Domain’s metasedimentary and granitoid gneisses. A series of discontinuous east-to-north-east trending EM conductors have been identified on the property, which are locally cross-cut by several NNW-trending regional faults.

Orr Project Map:

https://bmcms1.com/staging/skyharbourltd.com/_resources/images/Sky_Orr.jpg

The property has been covered by a variety of airborne and ground geophysics including magnetics, EM, gravity, and radiometric surveys, with the most modern work consisting of airborne MEGATEM flown in 2006 and an airborne gravity survey in 2007 that covered the western portion of the property. To date, only two drill holes have been completed on the property, both located in the northeast corner, intersecting granitic rocks. The property remains prospective for both unconformity-related and basement-hosted uranium mineralization.

Otter Project:

The Otter Project comprises a single mineral claim totalling 4,838 hectares, located in the northern Athabasca Basin approximately 41 kilometres southeast of the community of Black Lake. The property is underlain by Athabasca Group sandstones and conglomerates, which unconformably overlie metasedimentary and granitic gneisses of the Mudjatik Domain.

Historical exploration on the Otter Project includes airborne and ground electromagnetic and magnetic surveys, as well as limited prospecting and geochemical sampling. Notably, a 2007 MEGATEM survey identified a zone of strong conductivity, interpreted to represent a graphitic fault zone, which is intersected by a north-northwest trending magnetic dyke. This target area remains untested by drilling. The Otter Project is prospective for both unconformity-related and basement-hosted uranium deposits.

Otter Project Map:

https://bmcms1.com/staging/skyharbourltd.com/_resources/images/Sky_Otter.jpg

Pluto Bay Project:

The Pluto Bay Project consists of four claims covering 13,026 hectares, located approximately 14 km north of the Athabasca Basin, just east of the Snowbird Tectonic Zone. Historical mapping in the 1960’s showed the claims are likely underlain by Archean tonalitic to granitic gneisses, with local Paleoproterozoic amphibolites, metaquartzites, calc-silicates, marbles, and pelitic, psammopelitic, and psammitic gneisses. Minimal exploration work has been undertaken on the property, but historical geophysical survey programs in the southwestern part of the property revealed the presence of EM conductors, which remain untested. The Pluto Bay project is prospective for basement-hosted unconformity-related uranium mineralization. Also, it has the potential to host pegmatite-hosted U-Th-REE mineralization, similar to that at the nearby Charlebois Lake uranium-rich pegmatite.

Riou Project:

Riou consists of 8,620 hectares over six claims in the north-central portion of the Athabasca Basin and is underlain by the Athabasca Group sandstones and conglomerates. The sandstone is estimated to be 200 to 300 metres thick in this area and overlies basement rocks of the Archean-aged Tazin Gneiss Group. The property lies south of a significant east-northeast-trending magnetic lineament, indicative of a significant crustal offset in this area. Several discrete EM conductors totalling nearly 40 kilometres of strike length have been identified on the property, coinciding with magnetic lows and geochemically anomalous boulders. A major swarm of EM conductors is also present in the northwestern extent of the property. Historical exploration on adjacent claims immediately north of the project identified outcrop occurrences ranging from 72 to 375 ppm U, 3 to 7 ppm Th, and up to 8.24% P 2 O 5 . These highly anomalous values underscore the prospectivity of the area for uranium exploration.

Bend, Regamble, Hartle, and Compulsion Projects:

The Bend, Hartle, Regamble, and Compulsion projects are a series of early-stage exploration properties located in the eastern Wollaston Domain of northern Saskatchewan, approximately 40 to 70 kilometres east of the Athabasca Basin margin. The Bend Project comprises two claims totalling 9,114 hectares; Compulsion consists of two claims totalling 10,451 hectares; Hartle includes ten claims totalling 52,518 hectares; and Regamble encompasses five claims covering 24,208 hectares.

These projects were staked based on historical geological mapping in the area by the Saskatchewan Geological Survey, which showed that the Bend, Hartle, Regamble, and Compulsion projects are underlain by highly prospective Wollaston Group metasedimentary gneisses, including graphitic pelitic gneisses alongside the margins of Archean granitoid-gneiss domes, a prime target location for basement-hosted, unconformity-related uranium deposits in the Athabasca Basin.

While the Bend, Hartle, Regamble, and Compulsion projects were the focus of significant uranium and base metal exploration from the 1960’s through the 1980’s, primarily by SMDC (a precursor to Cameco), modern exploration has been limited. More recent work includes partial coverage by XDS-VLF-EM, DIGHEM, and radiometric surveys conducted in 2007 and 2014, which identified EM conductors across several areas of the properties. Historical exploration also encountered anomalous concentrations of copper, graphite, iron, and uranium, particularly in the Hartle Lake and Regamble Lake areas, where highly radioactive basement outcrops were observed. These projects are considered prospective for multiple mineralization styles, including basement-hosted, unconformity-related uranium, pegmatite-hosted U-Th-REE, and sedimentary-hosted Cu-Pb-Zn mineralization.

Pendleton Project:

The Pendleton Project comprises three newly acquired claims totaling 3,890 hectares, located approximately 70 kilometres southeast of Cameco’s Key Lake Operation and 114 kilometres northwest of the community of Southend. The project is situated along the Needle Falls Shear Zone at the intersection of the eastern Wollaston Domain and the western Peter Lake Domain. It is underlain by Wollaston Supergroup metasedimentary rocks, including psammopelitic, pelitic, and graphitic pelitic gneisses, as well as mylonitic and cataclastic rocks associated with the Needle Falls Shear Zone. Additionally, Archean granitoid gneisses, diorites, and gabbros of the Johnson River Inlier and Swan River Complex are present on the property.

Pendleton Project Map:

https://skyharbourltd.com/_resources/news/Sky_Pendleton_2025_07.jpg

Initial exploration on the Pendleton Project was carried out during the 1970’s and 1980’s and included airborne magnetic, radiometric, and electromagnetic surveys, as well as prospecting and geochemical sampling. More recent exploration activities included an airborne GEOTEM survey in 2004, followed by ground-based prospecting and geochemical sampling. In 2007, a ground HLEM survey was completed, leading to the drilling of a single hole, PL-003. This drill hole intersected faulted and sheared graphitic pelitic gneiss that returned anomalous values in several key pathfinder elements. The Pendleton Project is considered prospective for basement-hosted unconformity-related uranium deposits, as well as pegmatite-hosted U-Th-REE and sedimentary-hosted Cu-Pb-Zn mineralization.

Marketing Agreement with Outside the Box Capital:

Skyharbour also announced that it has entered into a marketing contract with Toronto-based marketing firm, Outside The Box Capital Inc. (‘OTBC’). OTBC specializes in various social media platforms and digital marketing strategies, and will be able to facilitate greater awareness and widespread dissemination of the Company’s news. In accordance with the agreement, services are set to commence on August 5 th , 2025, and run for a term of four months, in consideration of the Company paying OTBC an up-front cash fee of CAD $100,000 plus applicable taxes. OTBC owns no securities of the Company as of the date hereof and is arm’s length to the Company. The engagement of OTBC remains subject to TSX Venture Exchange approval.

Qualified Person:

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 and reviewed and approved by Serdar Donmez, P.Geo., VP of Exploration for Skyharbour, as well as a Qualified Person.

About Skyharbour Resources Ltd.:

Skyharbour holds an extensive portfolio of uranium exploration projects in Canada’s Athabasca Basin and is well positioned to benefit from improving uranium market fundamentals with interest in thirty-seven projects covering over 616,000 hectares (over 1.5 million acres) of land. Skyharbour has acquired from Denison Mines, a large strategic shareholder of the Company, a 100% interest in the Moore Uranium Project, which is located 15 kilometres east of Denison’s Wheeler River project and 39 kilometres south of Cameco’s McArthur River uranium mine. Moore is an advanced-stage uranium exploration property with high-grade uranium mineralization in several zones at the Maverick Corridor. Adjacent to the Moore Project is the Russell Lake Uranium Project, in which Skyharbour is operator with joint-venture partner RTEC. The project hosts widespread uranium mineralization in drill intercepts over a large property area with exploration upside potential. The Company is actively advancing these projects through exploration and drilling programs.

Skyharbour also has joint ventures with industry leader Orano Canada Inc., Azincourt Energy, and Thunderbird Resources at the Preston, East Preston, and Hook Lake Projects, respectively. The Company also has several active earn-in option partners, including CSE-listed Basin Uranium Corp. at the Mann Lake Uranium Project; TSX-V listed North Shore Uranium at the Falcon Project; UraEx Resources at the South Dufferin and Bolt Projects; Hatchet Uranium at the Highway Project; CSE-listed Mustang Energy at the 914W Project; and TSX-V listed Terra Clean Energy at the South Falcon East Project.

In aggregate, Skyharbour has now signed earn-in option agreements with partners that total to over $36 million in partner-funded exploration expenditures, over $20 million worth of shares being issued, and $14 million in cash payments coming into Skyharbour, assuming that these partner companies complete their entire earn-ins at the respective projects.

Skyharbour’s goal is to maximize shareholder value through new mineral discoveries, committed long-term partnerships, and the advancement of exploration projects in geopolitically favourable jurisdictions.

Skyharbour’s Uranium Project Map in the Athabasca Basin:

https://skyharbourltd.com/_resources/news/SKY_SaskProject_Locator_2025_07_16_v1.jpg

To find out more about Skyharbour Resources Ltd. (TSX-V: SYH) visit the Company’s website at www.skyharbourltd.com .

Skyharbour Resources Ltd.

‘Jordan Trimble’

Jordan Trimble

President and CEO

For further information contact myself or:

Nicholas Coltura

Investor Relations Manager

Skyharbour Resources Ltd.

Telephone: 604-558-5847

Toll Free: 800-567-8181

Facsimile: 604-687-3119

Email: info@skyharbourltd.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THE CONTENT OF THIS NEWS RELEASE.

The securities offered have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the ‘U.S. Securities Act’) or any U.S. state securities laws, and may not be offered or sold in the United States or to, or for the account or benefit of, United States persons absent registration or an applicable exemption from the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws. This press release does not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor in any other jurisdiction.

This release includes certain statements that may be deemed to be ‘forward-looking statements’. All statements in this release, other than statements of historical facts, that address events or developments that management of the Company expects, are forward-looking statements, including the Private Placement. Although management believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, and actual results or developments may differ materially from those in the forward-looking statements. The Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change. Factors that could cause actual results to differ materially from those in forward-looking statements, include market prices, exploration and development successes, regulatory approvals, continued availability of capital and financing, and general economic, market or business conditions. Please see the public filings of the Company at www.sedar.com for further information.