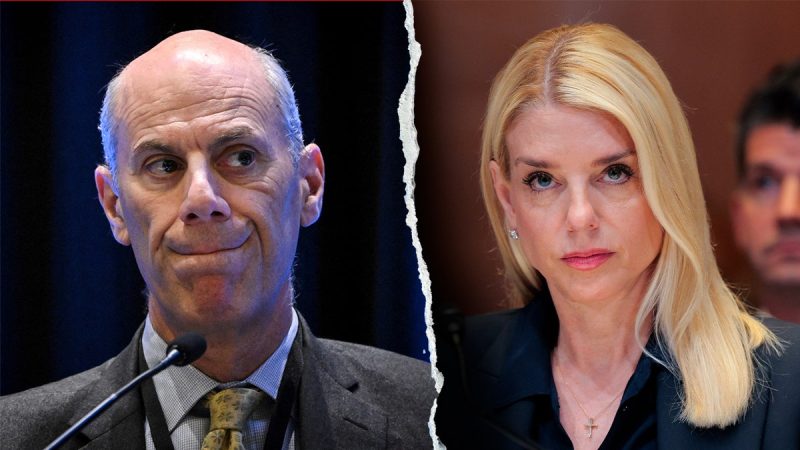

The Department of Justice has filed an official complaint alleging misconduct by US District Court Chief Judge James Boasberg. Fox News has reviewed the complaint which was written by Attorney General Pam Bondi’s Chief of Staff Chad Mizelle and addressed to the Chief Judge of the United States Court of Appeals for the District of Columbia Circuit, Sri Srinivasan.

Fox News has learned that the complaint was written and filed at the direction of Attorney General Pam Bondi.

‘The Department of Justice respectfully submits this complaint alleging misconduct by U.S. District Court Chief Judge James E. Boasberg for making improper public comments about President Donald J. Trump to the Chief Justice of the United States and other federal judges that have undermined the integrity and impartiality of the judiciary,’ says Mr. Mizelle.

Judge Boasberg is presiding over a high-profile case involving the deportation of several migrants to El Salvador and has talked about holding DOJ lawyers in contempt because of his assertion that his order to turn airborne planes around was not followed. President Trump has also made critical comments about Judge Boasberg.

The complaint details two occasions on which Judge Boasberg made comments the Justice Department alleges undermine the integrity and impartiality of the judiciary.

‘On March 11, 2025, Judge Boasberg attended a session of the Judicial Conference of the United States, which exists to discuss administrative matters like budgets, security, and facilities. While there, Judge Boasberg attempted to improperly influence Chief Justice Roberts and roughly two dozen other federal judges by straying from the traditional topics to express his belief that the Trump Administration would ‘disregard rulings of federal courts’ and trigger ‘a constitutional crisis.’ Although his comments would be inappropriate even if they had some basis, they were even worse because Judge Boasberg had no basis—the Trump Administration has always complied with all court orders. Nor did Judge Boasberg identify any purported violations of court orders to justify his unprecedented predictions.’

‘Within days of those statements, Judge Boasberg began acting on his preconceived belief that the Trump Administration would not follow court orders. First, although he lacked authority to do so, he issued a temporary restraining order preventing the Government from removing violent Tren de Aragua terrorists, which the Supreme Court summarily vacated.

Taken together, Judge Boasberg’s words and deeds violate Canons of the Code of Conduct for United States Judges, and, erode public confidence in judicial neutrality, and warrant a formal investigation.’

The DOJ is asking Chief Judge Srinivasan to refer the complaint to a special investigative committee as an inquiry is essential to determine whether Judge Boasberg’s conduct constitutes ‘conduct prejudicial to the effective and expeditious administration of the business of the courts.’ The complaint also asks that Judge Boasberg be taken off the case involving Venezuelan migrants who were deported to El Salvador, ‘to prevent further erosion of public confidence while the investigation proceeds.’

The case in question is J.G.G. v Trump.

This is the second time the Bondi DOJ has filed an official complaint against a federal judge. In late February, the DOJ filed a complaint about US District Judge Ana Reyes, concerning what the DOJ calls Judge Reyes’ ‘misconduct’ during the proceedings in Nicolas Talbott et al. v. Donald J. Trump et al., which is a case brought by two LGBTQ groups challenging the Trump Administration’s Executive Orders barring transgender individuals from serving in the US military.

News of the complaint comes at a time when the Trump administration has excoriated dozens of so-called ‘activist’ judges who have blocked or paused some of Trump’s sweeping executive orders from taking force in his second White House term.

Judge Boasberg in particular found himself at the center of Trump’s ire and attacks on so-called ‘activist’ judges this year, following his March 15 temporary restraining order that sought to block Trump’s use of the Alien Enemies Act to quickly deport hundreds of Venezuelan nationals to El Salvador.

Boasberg had ordered all planes bound for El Salvador to be ‘immediately’ returned to U.S. soil, which did not happen.

His emergency order touched off a complex legal saga that ultimately spawned dozens of federal court challenges across the country – though the one brought before his court on March 15 was the very first – and later prompted the Supreme Court to rule, on two separate occasions, that the hurried removals had violated migrants’ due process protections under the U.S. Constitution.

Boasberg, as a result, emerged as the man at the center of the legal fallout.

Trump administration officials have repeatedly excoriated Boasberg both for his order and his attempt to determine whether they acted in good faith to comply with his orders, and Trump himself has floated the idea that Boasberg could be impeached earlier this year – prompting Supreme Court Chief Justice John Roberts to issue a rare public warning.

The complaint, focused on months-old behavior and allegations surrounding Judge Boasberg— first tapped as a judge by then-President George W. Bush in 2002, comes at a time when he could again have a say in a major class action case brought by lawyers representing the former CECOT migrants.

Lawyers for the ACLU and others in the class asked Judge Boasberg earlier this month to reopen discovery in the case, citing allegations from a United Nations report regarding custodial status of migrants at CECOT, and the recent decision to remove the 252 migrants sent from the U.S. to El Salvador to Venezuela under the prisoner exchange.

Asked at a status hearing in court last week whether the Justice Department would comply with the court’s orders, DOJ lawyer Tiberius Davis said they would, ‘if it was a lawful order.’

They also said they would likely seek an appeal from a higher court.

In April, Judge Boasberg also ruled that the court had found ‘probable cause’ to hold the Trump administration in contempt for failing to return the planes to U.S. soil, in accordance with his March 15 emergency order, and said the court had determined that the Trump administration demonstrated a ‘willful disregard’ for his order.

The U.S. Court of Appeals for the D.C. Circuit stayed his original motion in April, and has yet to move on the matter.